Investment Opportunities

Your Partner in Profitable Real Estate Investment

The company’s goal is to increase its net worth through real estate investing by following a carefully planned set of guidelines. Real estate investing is a volatile, risky business. We lower our risk by analyzing data on properties, allowing us to make informed business decisions.We’ve set a goal of acquiring four properties in the first year; eight in the second year; and twelve in the third year. We expect to loan the company a total of$ 100,0000 in seed money to use as working capital to purchase the first properties.To generate working capital, we intend to resell most of the properties we acquire in the first few years and use the net profits to purchase an increasing number of long-term rentals. We believe that to create long-term growth and stability, we need to buy and hold a portion of the properties as rentals.

The financial goal of the company is to leverage this seed money into a substantial company with a Balance Sheet in excess of $1 million in assets after the first three years of operations. To achieve this goal, we intend to buy twenty-four properties by the end of our third year, generating net profits of $532,000 from the sale of nineteen properties and equity of $150,000 from holding five rental properties. After the third year, we plan to continue increasing our acquisition and sales volume each year, using the working capital to buy long- term rental properties in addition to buying and selling properties.

Primarily, revenue is forecast from two streams of income:

Net Profits from Buying and Selling Property

Rent from Long-Term Rental Property

At the end of the first year of operations, after having purchased and resold four properties with100,000 in seed money from the owners, the company’s Cash Balance is $186,018. In the second year, our Cash Balance falls to $117,529 due to repayment of the owners seed money loan, and decreases to $35,600 in the third year. This decrease is due primarily to an increase in the number of properties acquired for holding as long-term rentals. Without payback of our investments through the sale of these properties, we do not realize the same rate of cash infusion as in our first two years of operations.The company’s revenue for the first twelve months is $112,000, consisting of net sales from the sale of four of four properties acquired in that year. Revenue increases to $242,292 in the second year based on acquiring an additional eight properties, selling six of the properties and retaining two as long-term rental properties. Revenue rises only moderately in the third year to $296,822 based on acquiring an additional twelve properties, selling nine of the properties and retaining three as long-term rental properties.

The company’s net profit in the first year is $94,680 in the first year, decreasing to $44,792 in the second year due to payroll and benefit costs and decreasing slightly again in the third year to $11,692.

The company’s Total Liabilities and Capital for its first three years of operations are $138,018,

$517,529, and $1,107,697 respectively.

Important Assumptions

we looking for investor company a total of $100,0000 in seed money to purchase the first properties. These loans can be repaid when the company no longer needs that amount for working capital. Although it’s difficult to predict the exact number of properties the company will buy and sell, for the purpose of business planning we’ve set a goal of acquiring twenty-four properties in the next three years: four in the first year; eight in the second year; and twelve in the third year.We recognize the volatility inherent in the real estate market. Current market indicators show a falling market with prices decreasing, inventories increasing, and interest rates rising. As the market falls, properties owned by the company may not continue to have strong equity positions that might have been tapped for down payments on future acquisitions. We also recognize that real estate is an illiquid market and selling our inventory of properties may be difficult in a buyer’s market.

Tax Issues

As an LLC, we’re subject to “pass-through” taxation, meaning that the income of the LLC is passed through to the owners and taxed at our personal income tax rates. As the owner’s individual tax situations are different, we defer to our accountants for taxation guidance on all properties we buy and sell. Short-Term Capital Gains: Property held for one year or less is considered to be held on a short-term basis. If we sell a short-term capital asset, any related gains will ‘flow through’ to the individual owners, which are taxed at our individual tax rate.Self-Employment Tax: All business income generated by the LLC is subject to self- employment tax for the owners.We use a Cash Basis accounting method with a fiscal year of January through Decembe

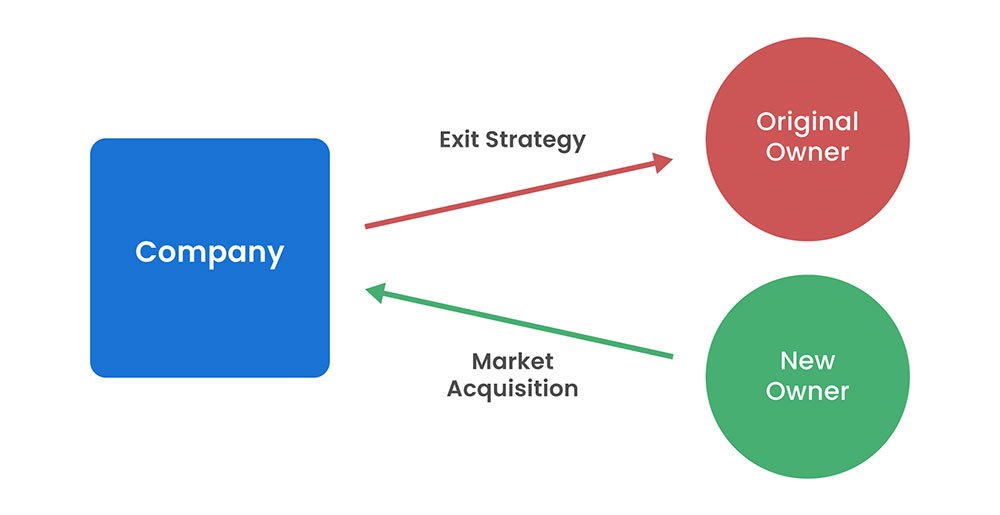

Exit Strategy

Exit Strategies for Properties

The owners have designed this business plan to allow for specific exit strategies for all properties acquired. We may sell each property as market conditions allow and will seek guidance from our accountants to review each property’s profit based on future market conditions and our personal tax situations. If market conditions continue downward, we may not be able to sell a property for our required net profits. In this case, we’ll attempt to hold the property as a long-term rental, assuming our cash flow situation allows. As a last resort, we’ll sell the property as a net loss and attempt to manage the loss through tax benefits for capital gains and losses.

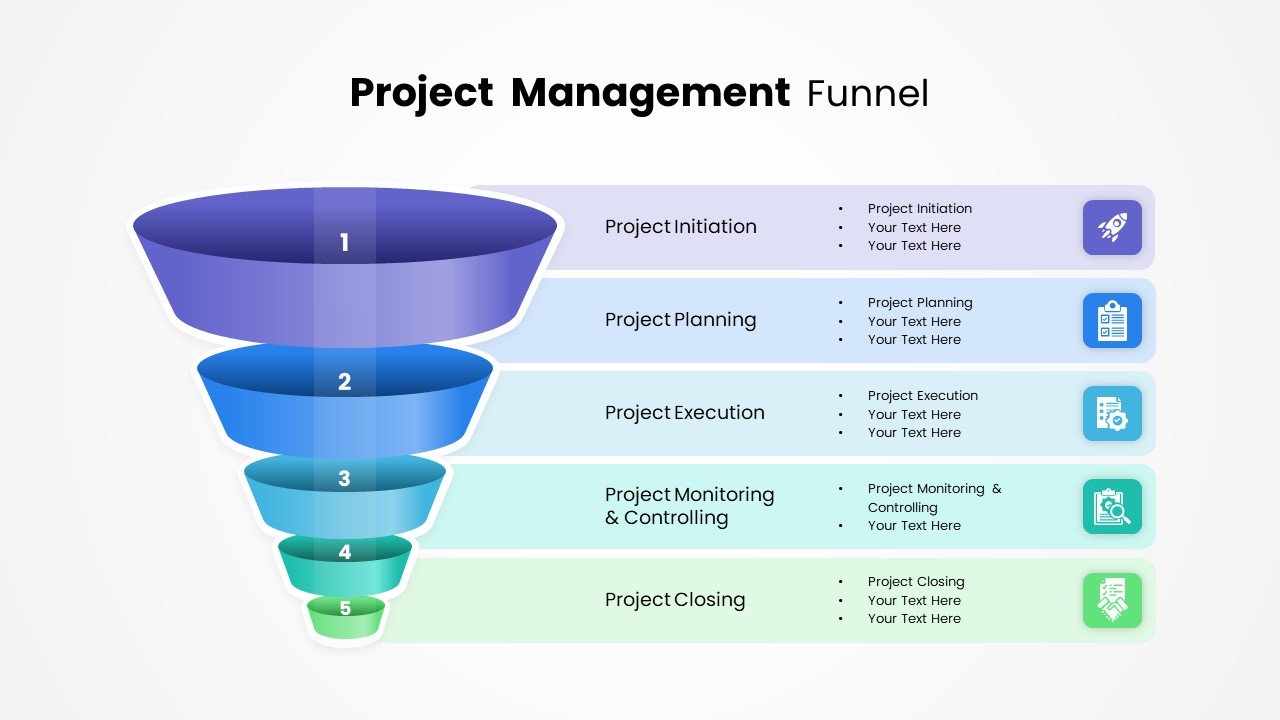

Our Investment Funnel:

-

Proprietary Sourcing:

We utilize advanced data analytics and off-market networks to identify properties with the greatest potential for forced appreciation. -

Value-Add Execution:

Our construction team determines the most impactful renovations, prioritizing cost-effective improvements that drive the highest ARV (After-Repair Value). This includes:

- Structural and cosmetic repairs.

- Optimizing floor plans.

-

Strategic ADU construction

to maximize the property's density and income potential.

Exit Strategy:

We execute a seamless exit, leveraging our in-house expertise whether it’s a quick sale to a retail buyer or professional property management for a rental hold.

| Investment Goal | Primary Strategy | Typical Time Horizon | Risk Profile |

| Capital Growth | Fix & Flip (SFH/ADU) | 6-12 Months | Moderate |

| Income Generation | Buy & Hold (SFH + ADU Rental) | 5+ Years | Low to Moderate |

| Immediate Equity | Distressed Asset Repositioning | 12-24 Months | High |

Investment Goal Primary Strategy Typical Time Horizon Risk Profile

Capital Growth Fix & Flip (SFH/ADU) 6-12 Months Moderate

Income Generation Buy & Hold (SFH + ADU Rental) 5+ Years Low to Moderate

Immediate Equity Distressed Asset Repositioning 12-24 Months High

Invest With Us

Apex Capital & Development offers opportunities for accredited investors seeking to participate in high-yield, secured real estate projects. Our investments are backed by tangible, hard assets and managed by a team with a proven track record in both finance and construction.

Contact Apex Capital & Development

Ready to discuss your project, investment goals, or financing needs?

Apex Capital & Development

Phone: [Insert Your Phone Number Here]

Email: [Insert Your Email Here]

Website: [Insert Your Website Here]

Connect with our Hard Money Team:

Email: lending@[YourCompanyDomain].com

Connect with our Development Team:

.com

property

Buy properties at wholesale prices; resell properties at retail prices:

The key to the company’s investment strategy is in purchasing properties at wholesale prices. At the heart of the company’s strategy is the ability to identify and secure good deals, targeting properties that can be purchased for at least 20-25% less than retail value. If targeted correctly, purchasing discounted, below-market properties can immediately provide positive returns. We can either assign the sales contract to another investor (for a profit) without taking possession of the property; rehab and resell the property at a retail price; or hold the property as a long-term rental investment.

Maintain adequate cash reserves within the company:

Debt management and cash flow is of paramount concern for the company. We carefully manage the company’s cash flow situation, never allowing our cash reserves to fall below a predetermined level.

Make offers based on our Maximum Purchase Price worksheet:

To consistently achieve positive net profits, the company has developed a spreadsheet to forecast each property’s net cash profit opportunity. The formula is based on determining the bottom line amount of net profit the company can expect from purchasing a property. Every offer to buy is based solely on whether the investment is a sound business decision. Simply, if the numbers suggest the property may prove to be a successful investment, then an offer is made for the property. The offer price is determined by the formula – which limits our risk in estimating the properties net worth to the company. We limit the number of offers on the table at any given time to the amount of liquid cash accessible; any investor or partnering opportunities present; and the amount of credit we have available.

Build and rely on a team of professionals:

We actively build and proactively use a team of professionals with deep experience in real estate investing. The team includes an attorney skilled in real estate; an accountant; several contractors that work consistently with real estate investors; several mortgage brokers and private money lenders; a title company; and a network of like-minded real estate investors. We enthusiastically participate in our local real estate investment association, taking advantage of the educational opportunities as well as the opportunity to meet other investors.

Establish and follow a goal-based timeline:

Setting goals and then following through with each goal is imperative for planning our business. We recognize that investing in real estate cannot be entirely planned, as the actual speed at which properties are purchased and resold is not something we can accurately predict. Nor can we predict market conditions. Following a goal-based timeline keeps us moving forward in achieving our objectives.

Develop and follow exit strategies for each property and for the company:

We have a clear strategy for the intent of each property before we make an offer to buy. Just as importantly, we’ve developed an internal Operating Agreement that clearly defines how the company functions, including specific methods regarding how to cease all company operations, close the company, pay all debts and divide the company’s assets between the owners.

Buying, Holding and Selling Properties

We follow a straight-forward process for identifying, buying, holding, and selling property. The process includes:

- Lead Generation

- Researching Properties

- Determining the Maximum Purchase Price

- Making Offers

- Financing

- Rehabbing

- Holding Properties as Rentals

- Selling Properties

Lead Generation

Key to the company’s strategy is a marketing plan designed to attract motivated sellers into our lead generation program. The plan is based primarily on generating leads from regional Internet advertising; maintaining a property database; developing a letter-writing campaign targeting pre-foreclosure property owners; displaying signs prominently in our targeted neighborhoods; and networking within our local real estate investment community. We’ve included a detailed marketing plan within this business plan.

Researching Properties

Once leads are established, we research the properties to determine whether we should present an offer to the owner. We use two primary means of researching properties.

First, we use a proprietary Maximum Purchase Price worksheet to help us determine whether to pursue a property. The worksheet is a vital component in deciding to make offers on properties, as it helps determine several important factors: the retail value of the property; the maximum wholesale price we can offer for the property; the amount of cash required for buying, rehabbing, and reselling the property; and the likely net profit for the company when we resell the property. We review the worksheet in detail in the following section.

Additionally, we research the property by accessing the County Assessor and Treasurer’s records. Specifically, we’re looking for how much equity the owner has in the property and if any liens are recorded against the property.

The Maximum Purchase Price Worksheet

The decision to buy and sell any property is based on an evaluation using the company’s Maximum Purchase Price worksheet. Using the worksheet for each property allows the company to apply a formula-like approach in our effort to consistently generate positive net profits. The worksheet breaks down the decision-making process into a simple

The worksheet is a formula-based MS Excel file consisting of thirteen simple areas, labeled as Sections A through L. The premise of the worksheet is straightforward. First, we estimate the price at which we realistically could resell the property. We refer to this as the retail value of the property. After estimating the retail value, we then forecast

the property’s net profit potential by subtracting all costs associated with acquiring, rehabbing, reselling, and profiting from the resale of the property. The number we come up with is the maximum amount we would pay for a property, which we refer to as the wholesale price. Again, the business model of the company is to only buy properties for wholesale prices, then either resell the properties at retail prices or hold the properties as long-term rentals.

Future Services

Property Acquisition:

We’ve launched the company with the development of the Property Acquisition division. The role of the division is to acquire, hold, and resell residential real estate properties. The properties are viewed as inventory assets of the company, purchased for the purpose of bringing net profits into the company when the properties are resold or refinanced.

Investor Participation Opportunities:

We plan to seek passive investors to provide working capital for each acquisition, with payback of the initial investment and a percentage return-on-investment to the investor when the property is sold.

Property Management:

The Property Management division will be responsible for managing all properties that the company holds as long-term rentals. Additionally, the company can provide property management services to real estate investors for a fee.

Real Estate Brokerage:

We may establish a full-service real estate brokerage to handle all internal transactions for buying and selling the company’s properties, along with providing brokerage services to real estate investors and individual home buyers and sellers.

Mortgage Financing:

We’ll investigate developing a division specializing in investment financing for investors and individuals seeking real estate financing, primarily through private money loans.

Complete Investment Services and Consulting:

The company may create a division that advises real estate investors in their long-term investment strategies and provides comprehensive services for their investment needs. The goal is to provide a one-stop solution for an investor through a combined packaging of our divisions and resources: Property Acquisition; Investor Participation Opportunities; Property Management Services; Real Estate Brokerage Services; and Mortgage Financing.

The worksheet is a formula-based MS Excel file consisting of thirteen simple areas, labeled as Sections A through L. The premise of the worksheet is straightforward. First, we estimate the price at which we realistically could resell the property. We refer to this as the retail value of the property. After estimating the retail value, we then forecast

the property’s net profit potential by subtracting all costs associated with acquiring, rehabbing, reselling, and profiting from the resale of the property. The number we come up with is the maximum amount we would pay for a property, which we refer to as the wholesale price. Again, the business model of the company is to only buy properties for wholesale prices, then either resell the properties at retail prices or hold the properties as long-term rentals.

Section A: Property Address

In the first section, we simply note the address of the property:

Section A: Property Address

5808 Any Street 00000

Section B: Comparable Property

The next section notes the best comparable property that’s sold in the neighborhood in the last few months. This information is generally found in the regional Multiple Listing Service (MLS), which can be accessed by a Realtor. The information includes the comparable property’s address; the square footage; the price for which the property sold; and the subsequent cost per square foot. The cost per square foot is the price the property sold for divided by the square footage of the property.